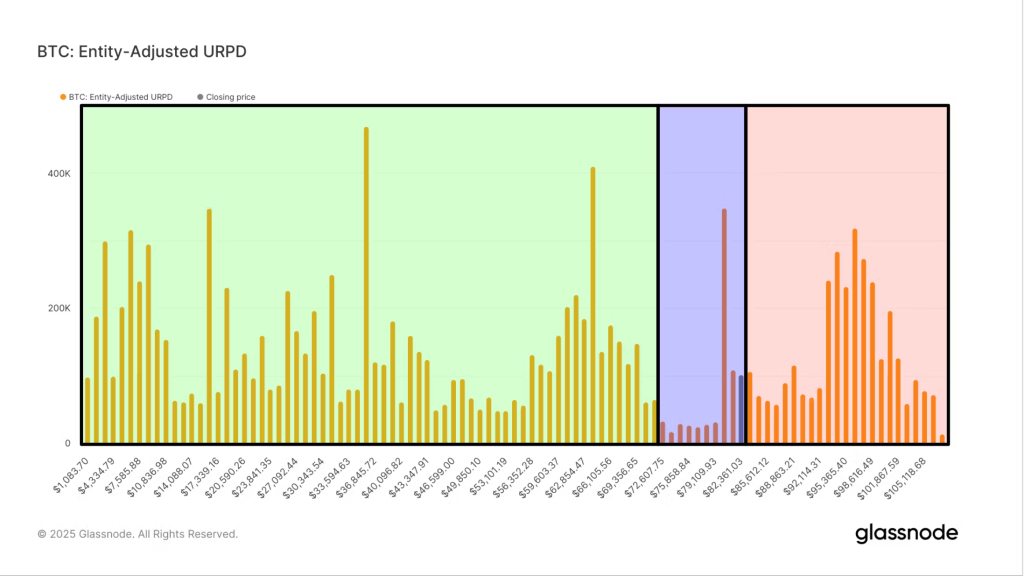

Bitcoin (BTC) is facing a critical juncture as on-chain analysis suggests a significant lack of trading activity between the $70,000 and $80,000 price levels, potentially leading to a rapid price decline if the current pullback continues below $80,000.

According to data from Glassnode, a prominent blockchain analytics firm, this so-called “supply gap” emerged in early November of last year following a swift price surge from $70,000 to over $80,000. This rally coincided with the hypothetical victory of pro-crypto candidate Donald Trump in the U.S. Presidential election, triggering a wave of bullish sentiment. However, the rapid nature of this price movement meant that very little Bitcoin changed hands within that $10,000 range.

Glassnode’s UTXO Realized Price Distribution (URPD) chart visually represents this phenomenon, highlighting the limited volume of Bitcoin whose last transaction occurred between $70,000 and $80,000. This indicates that the number of traders who acquired Bitcoin within this range is significantly lower compared to other price levels.

The implications of this supply gap are concerning for Bitcoin bulls. Should the cryptocurrency’s price fall below the current consolidation level above $80,000, the lack of substantial holder interest within the $70,000 to $80,000 range suggests weak support. This means there may be fewer buyers looking to “buy the dip” at their acquisition cost, potentially leading to a sharper decline.

Analysts point to the previous all-time high of approximately $73,000, set in March 2024, as the next significant support level if the $80,000 threshold is breached.

Adding to the potential downward pressure, Glassnode data reveals that around 20% of the total Bitcoin supply is currently held at a loss, meaning these coins were purchased above the current price of approximately $83,000. These holders might be inclined to sell if the price continues to fall, further exacerbating the selling pressure below $80,000.

The current analysis comes amidst a broader price correction for Bitcoin, which has seen a 30% pullback from its all-time high of $108,000. Glassnode also reports that short-term holders have already sold off roughly 100,000 BTC during this period.

The combination of a significant supply gap between $70,000 and $80,000, a substantial portion of the supply being held at a loss, and ongoing selling pressure from short-term holders paints a cautious picture for Bitcoin’s immediate price trajectory. While the long-term outlook for the cryptocurrency remains a subject of ongoing debate, this analysis highlights a potential vulnerability that could lead to further price declines in the short term. Investors and traders will be closely watching the $80,000 level to gauge the strength of current support and the potential for a deeper correction.