- XRP price is glued to support at $2.00 as breakout attempts lose momentum at around $2.22.

- Whale risk appetite grows as addresses with between 10 million and 100 million XRP account for 11.83% of the total supply.

- XRP exchange inflows plummet to 74 million tokens daily, suggesting reduced sell-side pressure.

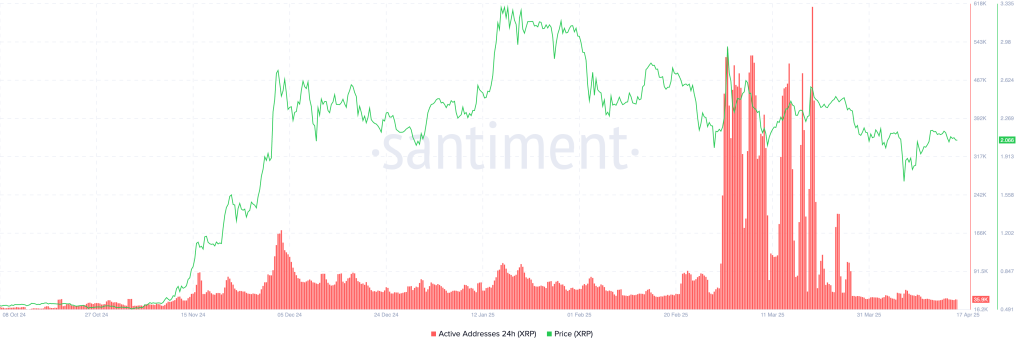

- XRP’s 24-hour active addresses dropped, per Santiment, which indicates low network activity and weakening bullish momentum.

XRP Price Consolidates Above Crucial $2.00 Support

Ripple’s XRP token is currently navigating a critical phase, holding firm above the significant psychological support level of $2.00. Despite attempts to rally, recent XRP price action shows momentum stalling around the $2.22 resistance mark, highlighted by the 100-day Exponential Moving Average (EMA). This consolidation period, observed during recent trading sessions, suggests market indecision as bulls and bears battle for control.

Whale Accumulation Hints at Underlying Strength for XRP

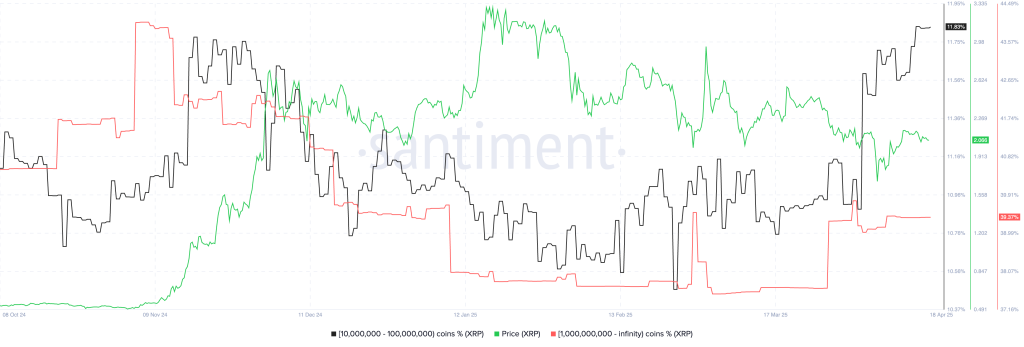

A potentially bullish signal emerges from on-chain data analysis. According to Santiment, large XRP holders, often referred to as “whales,” are increasing their positions. Specifically:

- Addresses holding between 10 million and 100 million XRP have expanded their share of the total supply to approximately 11.83% recently, up from 10.91% at the beginning of April.

- The largest whale cohort (holding over 1 billion XRP) has also increased its holdings, now controlling around 39.37% of the total supply, compared to 37.67% in late March.

This consistent whale accumulation during a period of price consolidation indicates a strong belief among major players in XRP’s future potential, suggesting a high-risk appetite despite broader market conditions.

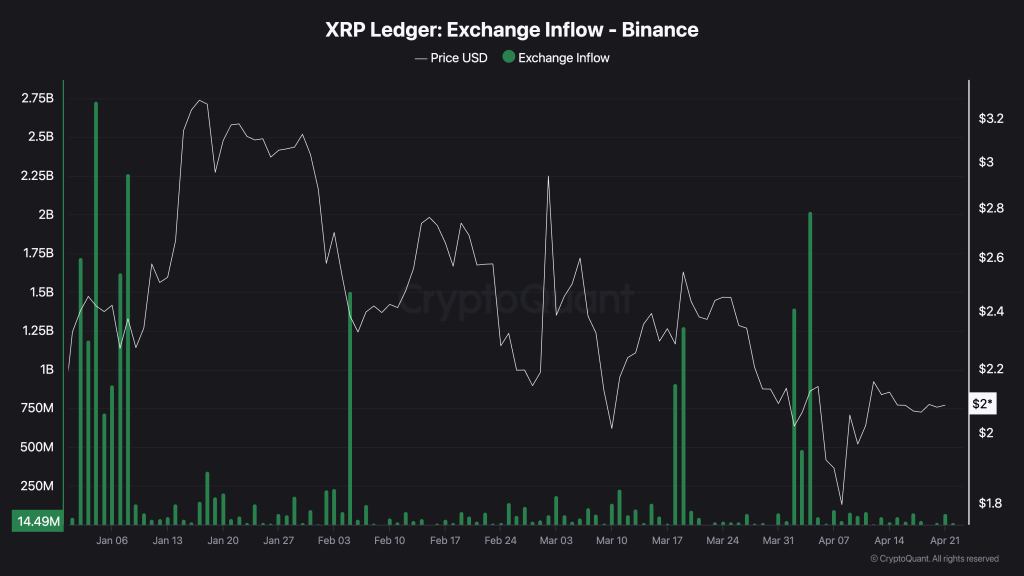

Reduced Exchange Inflows Ease Selling Pressure on Ripple

Further supporting a potentially positive outlook, data from CryptoQuant reveals a significant drop in XRP exchange inflows. Peaking near 2.7 billion XRP earlier in the year, daily inflows have plummeted to around 74 million tokens recently. This decline, particularly noticeable on major exchanges like Binance, suggests investors are increasingly choosing to hold their XRP rather than moving it to exchanges for potential selling, thereby reducing sell-side pressure.

Caution Signal: Declining XRP Network Activity

However, not all signals are bullish. A notable concern is the sharp decrease in 24-hour active addresses on the XRP Ledger. Santiment data shows a drop from a yearly high of roughly 612,000 active addresses on March 19 to approximately 36,000 as of April 17. This significant reduction in unique addresses interacting with the network (sending or receiving XRP) points to lower network activity. Persistently low activity could translate to weakening bullish momentum and dwindling market sentiment for Ripple.

XRP Technical Analysis: Key Levels to Watch

From a technical standpoint on the daily chart:

- Support: The immediate and crucial support remains at $2.00.

- Resistance: The primary hurdle is the $2.22 level (aligned with the 100-day EMA).

- RSI: The Relative Strength Index (RSI) sits above a descending trendline, offering a hint of underlying bullish optimism. However, it remains below the midline (50), indicating that selling pressure is still present and needs to be overcome.

XRP Price Outlook: Breakout vs. Breakdown Scenarios

The current XRP price action presents two main possibilities:

- Bullish Breakout: A decisive close above the $2.22 resistance could ignite buying interest, potentially creating the momentum needed for a rally towards the psychological target of $3.00.

- Bearish Breakdown: If the $2.00 support fails, XRP could first test the 200-day EMA around $1.96. A further breakdown could see the price target the April 7 low near $1.62 as it seeks liquidity before any potential recovery attempt.

Conclusion

The XRP price is currently balancing on the critical $2.00 support level. While significant whale accumulation and reduced exchange inflows provide bullish undercurrents, the declining network activity and persistent resistance at $2.22 warrant caution. Traders and investors should closely monitor these key levels ($2.00 and $2.22) for indications of Ripple’s next major price move.