Bitcoin’s price is currently trading around $85,500 on Thursday, experiencing a slight downturn after a nearly 5% gain the previous day. The market’s movement follows a series of significant events, including US President Donald Trump’s renewed call for the Federal Reserve to lower interest rates and his scheduled address at the Blockworks Digital Asset Summit later today.

The previous day’s price surge was largely attributed to the Federal Reserve’s decision to maintain current interest rates and its forecast for rate cuts later this year. Adding to the market’s intrigue, President Trump took to his Truth Social platform on Wednesday, urging the Fed to reduce interest rates as he believes tariffs are beginning to negatively impact the US economy.

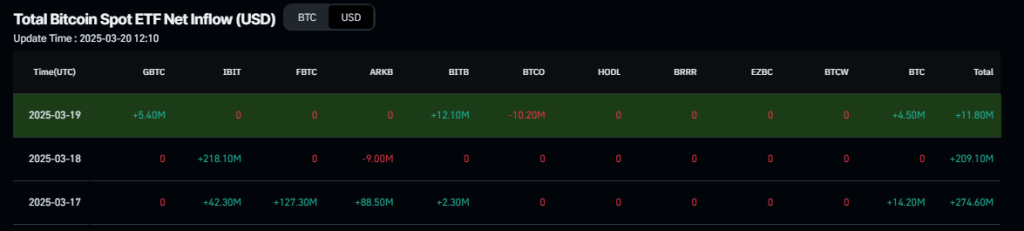

Meanwhile, US spot Bitcoin Exchange Traded Funds (ETFs) have recorded their third consecutive day of net inflows this week, suggesting a decrease in selling pressure. This positive trend in institutional investment is being closely watched by market participants.

Today marks a significant moment for the cryptocurrency industry as President Trump is set to address the Blockworks Digital Asset Summit in New York. This will be the first time a sitting US president has spoken at a crypto conference, underscoring the growing importance of digital assets in the political and economic landscape.

Market Sentiment and Expert Analysis:

Tracy Jin, COO of MEXC, commented on the potential impact of Trump’s address, stating that Bitcoin has already settled around the $85,000 mark. She cautioned that failure to hold this level could lead to a short-term sell-off, potentially pushing prices back to the $81,000-$83,000 range. However, she also noted that a supportive statement from Trump could trigger a positive market reaction, potentially driving Bitcoin towards $103,000 or even a new all-time high.

James Toledano, COO of Unity Wallet, highlighted the pivotal nature of Trump’s address for the Decentralized Finance (DeFi) sector, as it offers an opportunity for the president to clarify his administration’s stance on strategic Bitcoin reserves and broader regulations.

Technical Analysis:

Bitcoin’s price action saw it break above its 200-day Exponential Moving Average (EMA) on Wednesday, reaching a high of $87,000. Currently, it is retesting this EMA, which sits around $85,540. Analysts suggest that if Bitcoin finds support at this level, it could potentially rally towards the $90,000 mark.

However, the Relative Strength Index (RSI) indicates slight bearish momentum, and failure to hold the 200-day EMA could lead to a further decline towards the next support level at $78,258. The Moving Average Convergence Divergence (MACD) indicator, however, showed a bullish crossover last week, suggesting an underlying bullish trend.

Geopolitical Factors:

Investor confidence has also been buoyed by reports of talks between US President Trump and Russian President Vladimir Putin regarding a pause in strikes against energy infrastructure in Ukraine. Additionally, an agreement between Trump and Ukrainian President Volodymyr Zelenskiy to work towards ending the war has further boosted sentiment towards risky assets like Bitcoin.

Conversely, rising tensions in Gaza, with Israel launching a limited ground incursion, could potentially dampen investor confidence and lead to a risk-off environment in the crypto market.

Looking Ahead:

The market will be closely watching President Trump’s address at the Blockworks Digital Asset Summit for any indications of his administration’s future policies towards the cryptocurrency sector. The outcome of this speech, along with continued institutional investment trends and geopolitical developments, will likely play a significant role in shaping Bitcoin’s price trajectory in the near term. Sources and related content